DID YOU KNOW?! Educational Improvement Tax Credit Program

The YMCA participates in the Educational Improvement Tax Credit Program, a program supported by the PA Department of Community and Economic Development (DCED).

This is the rare win-win situation and here’s why.

Local businesses in the financial industry can receive tax credits if they contribute to designated organizations identified by the PA DCED. Specifically, a firm may receive a tax credit equal to 100% of the first $10,000 contributed to a Pre-K Kindergarten Scholarship Organization AND can receive a credit of up to 90% of any additional amount contributed during the rest of the year!

The Y receives the scholarship donations as a 501(c)(3) non-profit which runs pre-kindergarten programs for children ages three-six in Pennsylvania. These scholarships enable children from lower income households to join and thrive in the Y’s Pre-K programs.

This program also provides support for school age children throughout the state and supports Environmental Education programs specifically at the Upper Main Line YMCA.

Learn more about Y’s pre-school (Pre-K) programs.

Learn more about the EITC Program (and potentially join as a business)

To learn more about this program or how you can support the Y, call us at 610-643-YMCA (9622) ext 2153.

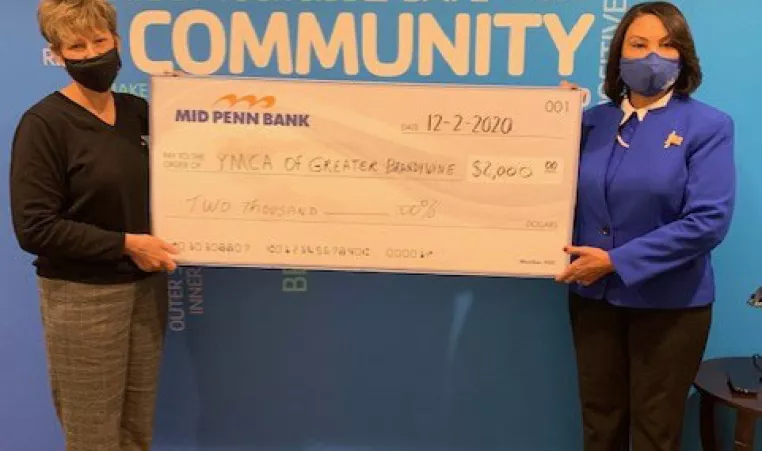

Typically, several local banks and financial organizations contribute to our Pre-K and environmental education programs. Thank YOU to our 2020 EITC partners: BB&T, Bryn Mawr Trust Company, Fulton Bank, M&T Bank, Meridian Bank, Mid Penn Bank and Philadelphia Insurance Companies.

This program gives the Y the ability to help educate our community’s children every day!